RETHINK INVESTING

Invest in CREIT

Home /

DISCOVER CREIT

Maximizing returns. Reducing risk.

A Path to Wealth Creation

Experience the benefits: CREIT seeks to provide consistent growth, durable income, tax-efficient returns, reduced risk, and strategic value creation through targeted acquisitions.*

*There can be no assurance that we will meet our investment objectives.

CREIT Performance Summary*

*As of March 31, 2025. Past performance is no guarantee of future results.

Attractive, Tax Efficient

%

Passive Income Yield

%

Tax-Equivalent

Dividend Yield3

Compelling Total Returns

%

Annualized Net Return

Since Inception4

SMARTER INVESTING. ENDURING VALUE.

CREIT seeks to provide investors with a distinct blend of portfolio benefits, including a robust investment experience.

Durable income

Consistent, tax efficient income

Reduced volatility

Experience lower volatility compared to alternative investments

Long-term growth

Positions investors for capital appreciation and the preservation of wealth

Gross Asset Value

Net Asset Value

Portfolio SF

Investments

Class A & Class B

Unit Class Shares*

$10.75

NAV per Unit Price*

*Represents the transaction price per unit of the applicable class of units of CIRE Real Estate Investment Trust, LLC (“CREIT”) and CIRE OpCo I, LLC (“CIRE OpCo”) for subscriptions accepted as of July 1, 2025. The transaction price per unit is equal to the NAV per unit as of May 31, 2025.

*As of May 31, 2025. Past performance is no guarantee of future results.

| May | YTD | 1-Year | 2-Year | 3-Year | 5-Year | Inception to Date4 |

|---|---|---|---|---|---|---|

| 0.89% | 4.94% | 13.09% | 11.54% | 11.31% | 11.91% | 12.72% |

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | $10.56 | $10.62 | $10.67 | $10.71 | $10.75 | |||||||

| 2024 | $10.05 | $10.08 | $10.13 | $10.18 | $10.21 | $10.23 | $10.26 | $10.29 | $10.37 | $10.42 | $10.46 | $10.51 |

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 1.01% | 1.01% | 0.99% | 0.94% | 0.89% | 4.94% | |||||||

| 2024 | 0.46% | 0.35% | 1.92% | 0.46% | 0.37% | 1.65% | 0.29% | 0.31% | 2.30% | 1.04% | 0.98% | 0.96% | 11.65% |

| 2023 | 1.47% | 0.27% | 0.18% | 0.23% | 0.42% | 0.78% | 0.28% | 0.43% | 1.61% | 0.64% | 0.49% | 1.81% | 8.95% |

| 2022 | 0.12% | 0.62% | 5.44% | 0.43% | 0.37% | 3.70% | 0.47% | 0.48% | 0.78% | 0.39% | 0.38% | 1.62% | 15.70% |

| 2021 | 0.46% | 0.54% | 2.44% | 0.01% | 0.23% | 2.26% | 0.44% | 0.34% | 4.56% | 0.81% | 0.60% | 2.45% | 16.10% |

| 2020 | 0.50% | 0.48% | 0.10% | 0.12% | 0.26% | -2.71% | -0.48% | -0.16% | 5.42% | 0.39% | 0.28% | -0.24% | 3.85% |

| 2019 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 5.09%2 | 2.37% | 0.39% | 3.52% | 11.80% |

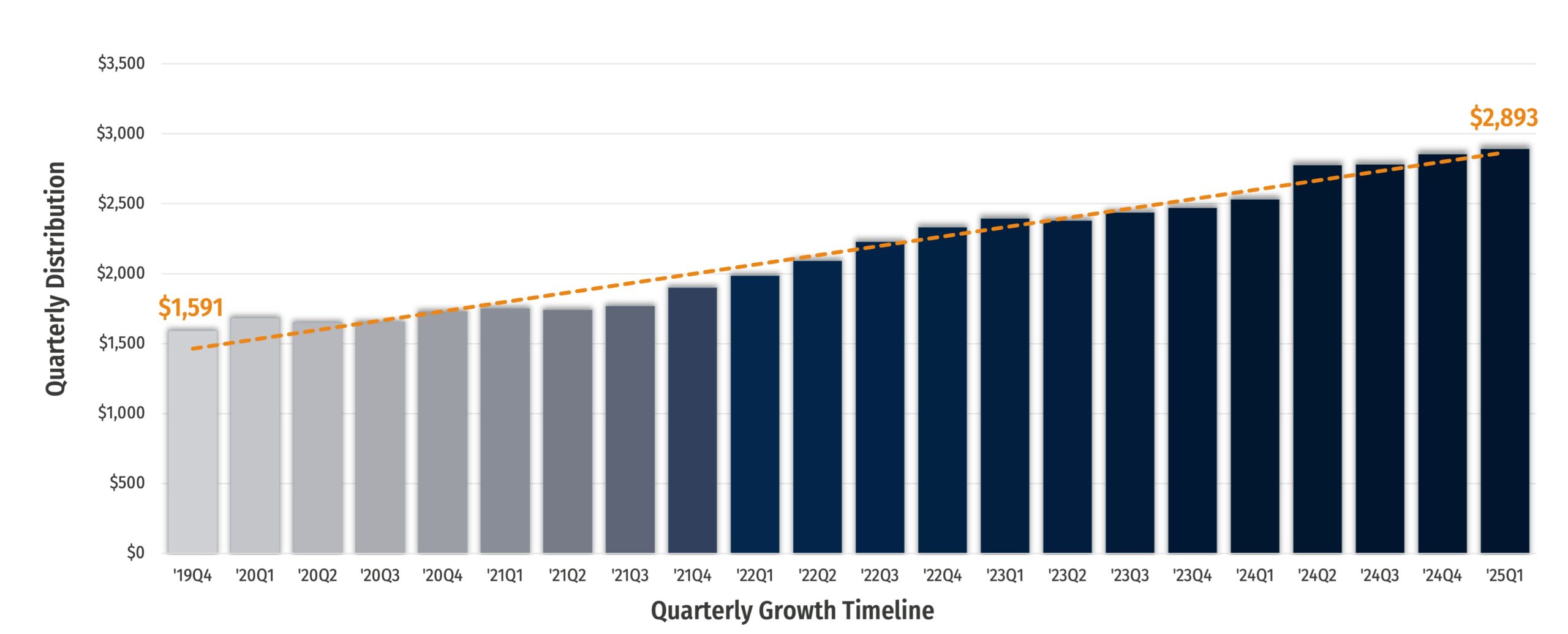

Quarterly Summary of Historical Dividend Growth4

*As of March 31, 2025. Past performance is no guarantee of future results.

ABOUT THE CREIT PLATFORM

Unlocking Prosperity

Durable Cash Flow and Value-Add Appreciation

CREIT, a private, non-traded, perpetual-life real estate investment trust, was founded with an initial contribution of 11 assets, including seven multi-tenant discount and daily need retail centers and four mission-critical single-tenant industrial properties. Our portfolio’s growth is propelled by a middle-market approach to private real estate, focusing on income-generating property types through new acquisitions and 721-exchange contributions.

Invest in CREIT for a diversified REIT platform offering durable cash flow and value-add appreciation in dynamic markets.

WAYS TO INVEST

Grow and preserve wealth.

Direct Investment into CREIT

Passive investing, seeking consistent income growth

Direct Investment

Accredited investors have a unique opportunity to invest directly in CREIT, gaining access to a diversified portfolio of commercial real estate assets that expects to directly benefit from consistent growth, durable income generation, and tax-efficient returns. Leverage the expertise of our team and stability of our platform to seek long-term financial growth and wealth preservation.

Preserve wealth, defer taxes

1031 or 721 Exchange

Explore tax-efficient investing by leveraging the benefits of 1031 and 721 exchanges. Our platform provides a seamless transition for investors looking to defer capital gains taxes through reinvesting capital (1031) or property (721) while gaining exposure to a diversified portfolio of income-generating commercial real estate. Learn how CIRE’s innovative approach aligns with your investment goals, offering a strategic pathway to seek long-term financial growth and wealth preservation.

Invest Now

Contact our team today. We’d be happy to answer any questions!

Important Footnotes + Disclosures

- CIRE Principals investment represents their investment in CREIT or properties held in CREIT and will fluctuate over time.

- Reflects the distribution from the most recently reported quarter-end period, annualized and divided by the average monthly beginning NAV from the most recently reported quarter-end period, inclusive of investment effective at the beginning of each month

- Estimated tax equivalent yield based on a hypothetical $100,000 investment using the highest US Federal marginal tax rates for income (37%) and long-term capital gains (20%) utilizing most recently available NAV REIT filings (2023) and Nareit average taxation of public REIT common share dividends (2022) for tax allocations among income types. May not be reflective of an investors actual experience

- Inception date for interests in CREIT is September 1, 2019.

- Historical net asset value (“NAV”) per unit reflects the NAV per unit of CREIT and CIRE OpCo.

- This material contains references to our NAV and NAV-based calculations, which involve significant professional judgment. Our NAV is generally equal to the fair value of our assets less outstanding liabilities, calculated in accordance with our valuation guidelines. The calculated value of our assets and liabilities may differ from our actual realizable value or future value, which would affect the NAV as well as any returns derived from that NAV, and ultimately the value of your investment. As return information is calculated based on NAV, return information presented will be impacted should the assumptions on which NAV was determined prove to be incorrect. NAV is not a measure used under GAAP and the valuations of and certain adjustments made to our assets and liabilities used in the determination of NAV differ from GAAP. Investors should not consider NAV to be equivalent to members’ equity or any other GAAP measure.

- On January 1, 2024, CREIT and CIRE OpCo unitized their equity interests, each with an initial unit price of $10.00 per unit. The words “we”, “us”, and “our” refer to CREIT, CIRE OpCo and its consolidated subsidiaries, unless the context requires otherwise.